Provident Music Distribution

The Problem:

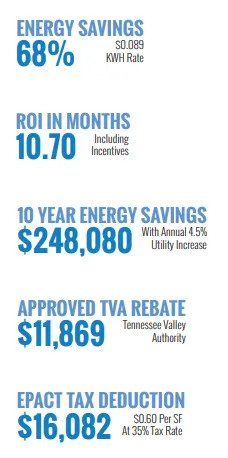

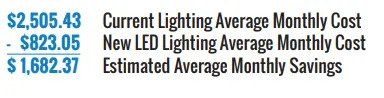

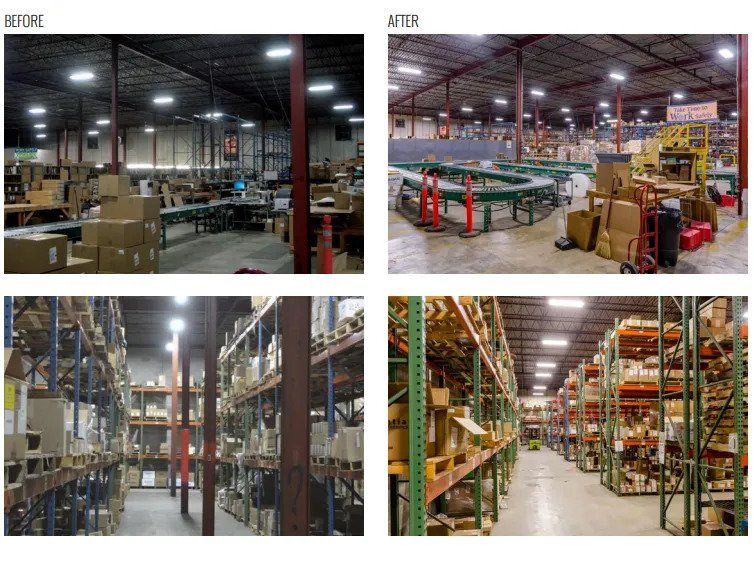

Like many warehouses that have been expanded and modified over time, the Provident Music Distribution building was lit with a mix of older lighting technologies such as Metal Halide and T8 and T12 linear fluorescents. In addition to being inefficient and requiring significant maintenance, these older fixtures lacked any type of dimming or motion control capability.